Learn how to identify UBOs across APAC markets using verified registry data and ownership tracing tools

Effective business verification services (KYB) and KYC software checks serve as crucial weapons in the fight against financial crime. Just as light exposes hidden corners, these measures reveal the true identities and intentions of businesses and customers. By pursuing transparency not only of the businesses themselves, but also of those who own and control these entities, firms will be better able to thwart attempts to wash illicit gains through legitimate channels, which undermine the integrity of global financial systems.

Ultimate Beneficial Owners

UBOs – or Ultimate Beneficial Owners – refer to the individuals who own or control a business entity, trust or other legal structure. The Financial Action Task Force (FATF) defines a UBO as:

“the natural person(s) who ultimately owns or controls a customer and/or the natural person on whose behalf a transaction is being conducted. It also includes those persons who exercise ultimate effective control over a legal person or arrangement.

In this context, the FATF defines a natural person as those that meet one or more of the following criteria:

- Directly or indirectly hold a minimum percentage of ownership interest in the legal person (usually a business or other similar legal entity structure) – 25%

- Shareholders who exercise control alone or together with other shareholders, including through any contract, understanding, relationship, intermediary or tiered entity (a majority interest approach) – 25% of an entity’s voting rights

Why UBO Transparency Matters

UBOs may seek to exploit intricate corporate structures to obfuscate the true illicit nature of their business or identity in an attempt to evade regulatory scrutiny. In March 2022, the FATF agreed on tougher global beneficial ownership standards in its by requiring countries to ensure that competent authorities have access to adequate, accurate and up-to-date information on the true owners of companies. It is imperative that firms determine and confirm the UBOs of their corporate customers to effectively evaluate risks in line with broader AML efforts.

This goes beyond financial services

Requirements to identify UBOs is not a novel concept for global financial institutions – the FATF became the first international body to set global standards on beneficial ownership in 2003. However, a number of Asian jurisdictions have begun expanding the scope of said requirements to include a far broader range of firms, for example:

- India – in May 2023, The Ministry of Finance broadened the scope and applicability of its Prevention of Money Laundering Act (PLMA) to include banking intermediaries, real estate agents, financial companies, and accountants.

- Singapore – as of June 28 2023, the government of Singapore introduced new AML measures for property developers. Under the new measures, developers must perform risk analysis, carry out customer due diligence (CDD) measures and report suspicious transactions.

Book a 15-min demo and see how AsiaVerify accelerates onboarding, reduces false positives, and keeps you audit-ready.

The Challenges of Identifying UBOs in Asia

Identifying UBOs is far from straightforward in any context, but Asia’s linguistic diversity, cultural nuances and varying data standards represent significant challenges for firms looking to conduct legitimate business in the region.

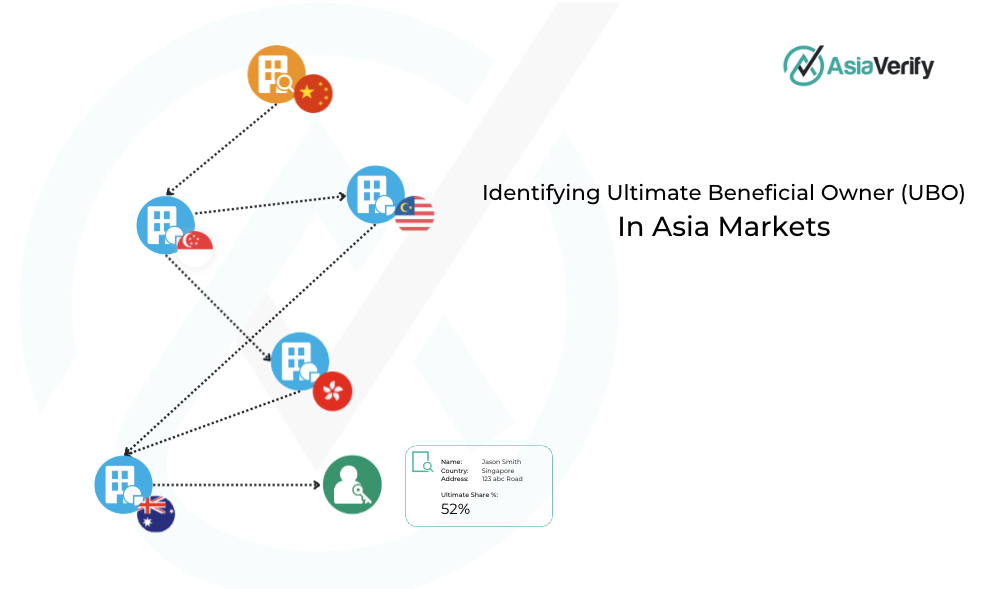

Complex ownership structures across multiple jurisdictions

While complex corporate structures are by no means unique to Asia, cultural practices and economic dynamics can lead to more intricate corporate arrangements. For example, family-owned businesses, conglomerates and networks of affiliate companies may present more convoluted ownership patterns which may prove challenging to unravel.

According to the 2016 World Investment Report titled “Investor Nationality – Policy Challenges”, circa 40% of foreign affiliates possess different passports to the country in which their firm is domiciled. These affiliates form intricate ownership networks with numerous international connections spanning an average of three jurisdictions. At the time, the top 100 multinational enterprises featured in UNCTAD’s Transnationality Index had on average more than 500 affiliates each, across more than 50 countries.

The OECD have observed significant differences across Asian jurisdictions with regards to corporate ownership; the People’s Republic of China and Vietnam, for example, are characterised by substantial state ownership, India and Korea maintain significant family ownership structures. Understanding these nuances is pivotal to ensuring the development of effective investigation of UBO information.

Linguistic barriers

Asia is home to over four billion people and more than 3,000 unique languages. This can hinder effective communication and cooperation in accessing accurate ownership information, which may in turn impede the transparency required for effective UBO identification.

Data quality and accessibility

Some Asian countries have less stringent company disclosure requirements regarding beneficial ownership information, and the availability and accuracy of data can vary widely across the region. For example, China has an established UBO registry offering easily accessible information for companies, whilst Singapore’s UBO registry is restricted for the sole purpose of law enforcement. On the other end of the spectrum, Indonesia is in the process of developing a transparent and publicly accessible UBO register, indicating a move towards enhanced data availability. Companies must understand the accessibility and quality of the data in each jurisdiction in which it seeks to operate in order to effectively analyse and risk score its corporate customers.

Book a 15-min demo and see how AsiaVerify accelerates onboarding, reduces false positives, and keeps you audit-ready.

The AsiaVerify Advantage

AsiaVerify helps firms to identify UBOs by providing real-time, high quality data of APAC corporations, customers and beneficial owners. Our solution offers automated access to translated records pertaining to ~350m companies and ~1.4bn individuals. By providing businesses with the most comprehensive, accurate and up-to-date information, AsiaVerify’s software can reduce UBO “blind spots” and enable firms to conduct business with confidence.

Data aggregation and visualisation

AsiaVerify’s proprietary UBO search technology enables automated real-time data extraction from a wide range of sources such as UBO registries or other relevant datasets. By pulling data directly from the source, firms can ensure they are accessing the most up-to-date and most accurate information from which to conduct their due diligence. Once aggregated, firms can visually unravel complex corporate structures within the platform itself to quickly identify all beneficial owners with a minimum holding of 10%, thus enabling users to quickly verify ownership structures and view connections between shareholders and companies.

Language translation

The world is becoming ever-more interconnected, and Asian firms are constantly engaging in cross-border business transactions which can significantly complicate the tracking of ownership information, particularly when taking into account the diverse language pool of the region. AsiaVerify leverages Natural Language Processing (NLP), including Asian Optical Character Recognition (ACR) technology to translate documents in the click of a button and, if necessary, turn non-Latin scripts into machine, and non-native, readable text. AsiaVerify automatically links this translated text directly back to source material so firms can evidence a robust audit trail of exactly where and how their KYC data inputs were translated.

Conclusion

AsiaVerify’s award-winning solutions are built with the specific purpose of empowering businesses to unlock the Asian markets` potential through robust and reliable client onboarding. As experts in KYC/KYB with Asia-based Clients, AsiaVerify knows which data exists for each region, where to find it and how to structure and translate it. With sophisticated automation capabilities, a proprietary UBO algorithm and connections with each region’s most trusted data, including official Government sources, AsiaVerify has built solutions which streamline and enhance client onboarding, executing complex and laborious onboarding checks in real-time.

If your firm is ready to break new ground in the Asian market, it’s time to consider AsiaVerify. Discover how AsiaVerify can help your business grow – explore the website, get in touch with our team, and let` begin your journey to success in the Asian market today.

Book a 15-min demo and see how AsiaVerify accelerates onboarding, reduces false positives, and keeps you audit-ready.