Jurisdictions Hub ❯ China China Verification & Risk Requirements

Overview

China’s KYB landscape at a glance

Fragmented registries, layered ownership, and language barrier China toughest markets to verify.

See Overview

Challenges

Why China is difficult to verify

Corporate data is spread across multiple systems, inconsistently, and often available only in Chinese.

Assess Challenges

Requirements

What you need for accurate KYB

Verified registry access, clear ownership visibility, structured translations, and AML signals.

Inspect Requirements

Resources

For China-focused teams

Access data sources, verification standards, and tools that help teams complete KYB, UBO, and AML checks.

Access ResourcesOverview China Jurisdiction Overview

Publicly available company information is mainly accessed via the National Enterprise Credit Information Publicity System (NECIPS), China’s primary national platform for business-licence data, corporate filings, and regulatory disclosures.

This jurisdiction profile summarises the key factual elements relevant to understanding corporate information in China.

Challenges When Verifying Companies In China

Language and Terminology Barriers

Official registry data is published entirely in Simplified Chinese, requiring accurate translation to correctly interpret legal and compliance-critical information.

Interpreting Business Scope Requirements

The business licence includes a Business scope field that defines the Activities a company is legally allowed To perform. Misinterpretation can lead To onboarding companies that are not Authorised to operate in a given sector.

Complex Corporate Structures

Ownership structures may involve Layered holdings, provincial Registrations, and state-linked Entities, making it difficult to identify Controlling parties without detailed Analysis.

No Centralised UBO Register

China does not maintain a public Register of ultimate beneficial Ownership. Ubo must be determined From shareholder disclosures, Historical filings, and related records.

Official Platform Access Difficulty

Intermittent overseas access and Chinese-language CAPTCHA checks can hinder the retrieval of official data and disrupt operational workflows.

Frequent Corporate and Regulatory Updates

Changes to business scope, legal representatives, and licence status occur frequently, making ongoing monitoring important for maintaining accurate KYB results.

Requirements For China Verification & Risk Assessment

Essential Identifiers for Companies in China

China uses a small set of core identifiers to match companies to official registry records.

Unified Social Credit Code (USCC)

China’s universal 18-digit identifier is assigned to every Registered entity. It is the primary key used across all

government systems to match and track companies.

Official Registered Name

The entity’s legal name in Simplified Chinese. This is the authoritative reference used in NECIPS and AMR records and

is required for accurate entity matching.

Registered Region

A provincial or municipal SAMR bureau supervises each company. This region determines which registry holds its

filings and historical changes.

Supporting Identifiers

Some companies list English names, industry codes or digital presence information; these may assist contextually but

are not used for formal record matching.

Common Public Documents Available in China

China publishes several standard corporate documents through its national and provincial registries, though availability varies by region and entity type.

Business Licence

China’s primary corporate record. It lists the USCC, the legal representative, the registered address, and the permitted

business activities.

Annual Report

Filed annually and publicly available through NECIPS. Reports include core operational details, compliance disclosures,

contact information, and changes in business activity.

Shareholder & Equity Filings

Public disclosures detailing shareholders, equity contributions, ownership movements and historical changes.

Sector-Specific Licences

Additional regulatory approvals for industries such as finance, logistics, education, healthcare and food services.

Historical Change Records

Updates filed with authorities showing past adjustments to address, business scope, registered capital or legal

representative.

Official Sources of Corporate Information

Corporate information in China is published across national, provincial and sector-level platforms maintained by government authorities.

NECIPS

The central public registry containing business-licence data, corporate filings, operational status and administrative penalties.

Provincial & Municipal AMR Platforms

Local SAMR portals, where filings may appear earlier or include region-specific details.

Industry Regulators

Authorities overseeing finance, transportation, education and other sectors publish additional licensing and compliance information.

Judicial & Enforcement Databases

Separate public systems providing court rulings, enforcement actions and disqualification records related to companies or individuals.

Resources Compliance Insights, Explained

Understanding China’s Beneficial Ownership Filing: A Guide for Businesses

Learn how China’s new UBO filing rules affect risk, transparency, and due diligence processes

Read MoreMerchant verification in the fast-lane

Speed up merchant KYB without cutting corners—learn how real-time tools reduce onboarding risk

Read MoreBirketts LLP Partners with AsiaVerify for China & Hong Kong KYB

Birketts LLP partners with AsiaVerify to deliver real-time business verification in China and Hong Kong

Read MoreNavigating APAC’s Unique KYB, UBO & KYC Challenges

Uncover the KYB, UBO, and KYC compliance complexities that global teams face in the APAC region

Read MoreSolutions How AsiaVerify Supports Compliance and Onboarding in China

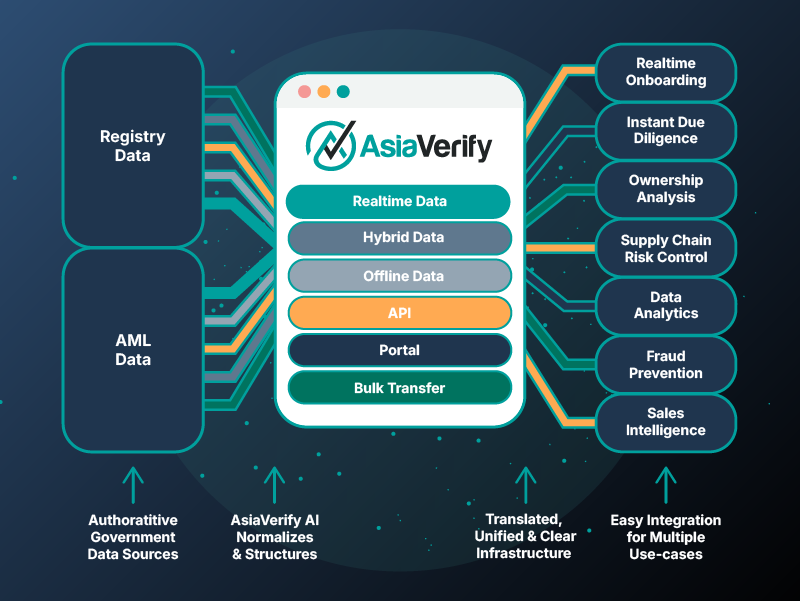

Real-time Registry Connection

AsiaVerify connects directly to NECIPS and official SAMR registry sources to retrieve live company status, registration data, and historical filings — ensuring information is current, accurate, and authoritative.

Directors & Shareholders Data

Official registry records are normalised and presented in English-ready reports, allowing teams to review legal representatives, directors, shareholders, and change histories without translation delays.

Automated Document Retrieval

Business licences, governance documents, and filing records are automatically fetched from official sources, reducing back-and-forth and streamlining document collection.

AI-assisted Translation & Normalisation

Chinese-language registry data is translated, structured, and normalised to align with international KYB standards, reducing misinterpretation of business scope, entity types, and regulatory indicators.

UBO Mapping & Ownership Analysis

AsiaVerify reconstructs ownership layers using disclosed shareholder details and historical filings, helping teams identify controlling individuals and entities across multi-tiered structures.

AML & Sanctions Screening

Entities, shareholders, and legal representatives are screened against sanctions, enforcement lists, and adverse media to support AML and CTF obligations across APAC.

API, portal and bulk access

Teams can integrate real-time verification through API, run checks on-demand in the portal, or process high volumes via bulk upload — ensuring KYB workflows match operational needs.

Ongoing monitoring & alerts

AsiaVerify continuously monitors changes to business status, registered details, shareholders, scope, and penalties, alerting teams when regulatory or structural changes occur.

From Sydney to Shanghai APAC Coverage You Can Trust