Why digital onboarding is becoming critical for financial services

MyBank, WeBank, Judo Bank, Livi VB, KakaoBank, Rakuten Bank… what do these businesses have in common?

They’ve all got the word ‘bank’ in their names which gives some of it away, but they’re more specifically all digital banks in the Asia-Pacific region.

Rapid Growth

The region has seen rapid growth in the establishment of digital banks due to a range of factors, such as improved technological solutions, increasing customer demand for flexibility and convenience, more license allocations and expanding regulation.

The introduction and growth of these digital banks is prompting a transformation in the way traditional banking is being conducted; there is decreasing focus on bricks-and-mortar branches, shifting towards improving digital customer experiences and providing optimal accessibility of services.

And the results speak for themselves – McKinsey reports that China’s digital banks have gained roughly 5% share of the country’s unsecured consumer loan market and over 7% of online SME loans. Similarly in South Korea, KakaoBank was launched in 2017 and now has roughly 5% share of the unsecured consumer loan market.

How are digital banks achieving this exponential growth?

It all starts with onboarding. As with any other product or service, first impressions last in the financial sector.

Onboarding is therefore a vital element to get right as it sets the tone for what customers can expect of the ongoing level of convenience, expertise and user experience that the business will deliver. Incorporating digital onboarding as a first touchpoint indicates to customers that the business is tech-savvy and interested in providing services in a way that is tailored to and suitable for customers.

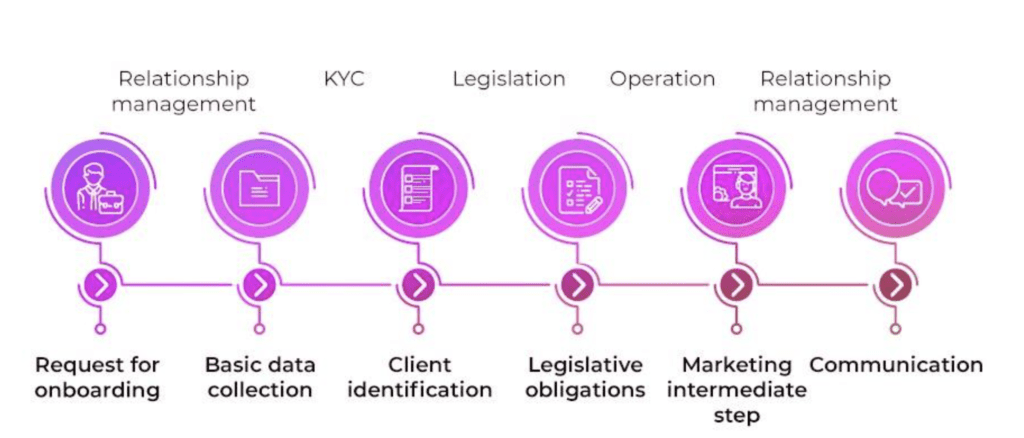

Digital onboarding encompasses all the usual steps of onboarding, such as identity verification and security checks, without the need for physical contact or branch visits. Instead, it utilises technological solutions to enable customers to be onboarded at a time and place that suits them.

This sits in stark comparison to traditional and manual onboarding processes, which often involve reams of manual paperwork, multiple questions and repeat visits to a branch. Such a high level of complexity and time consumption has been proven to lower customer acquisition and decrease customer satisfaction; in fact, Oracle RightNow found that 86% of customers are now willing to pay more for a better customer experience.

Source: www.o2inc.net

Finding the right balance

Digital banks use digital onboarding processes to provide customers with an easy and convenient way to access their services. And it’s not only banks that can benefit from introducing digital onboarding – investment and securities service providers, insurance companies, management companies and other fintech companies all stand to make gains if they implement digital onboarding processes in a smooth and integrated manner.

But while it may sound like the runway is clear for digital onboarding, there are many compliance issues that financial service businesses need to consider prior to implementation.

These compliance issues exist for good reason, e.g. to minimise money laundering, terrorist financing and other financial crimes, and are legislated in most jurisdictions. Hence digital onboarding processes require a suitable balance of safety and security whilst still offering the flexibility and speed that make it so appealing to customers.

Luckily, technology now exists to ensure both needs can be met, and regulation technology (RegTech) companies like AsiaVerify have stepped in to facilitate and support businesses with incorporating such technology.

Digital tools like video calls, voice recognition, facial biometrics, electronic signatures and digital identification combine to enable businesses to meet their Know Your Customer (KYC), Know Your Business (KYB), Ultimate Beneficial Owner (UBO), Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) obligations, whilst still providing an optimal digital customer onboarding experience.

Why digital onboarding has become non-negotiable

“… if banks don’t up their game, then tech companies will take over the industry’s business. There are hundreds of startups with a lot of brains and money working on various alternatives to traditional banking.” – Jamie Dimon, Chairman, President and CEO of JPMorgan Chase

With the proliferation of digital banks around the world, incumbent banks are feeling the pressure from customers to catch up in improving their processes or be left behind. And this pressure is not limited to banks, it extends to most goods and services as customer expectations have become overwhelmingly digital-first.

Introducing digital onboarding is a natural place to start. Major benefits for businesses are:

Smoother customer acquisition – setting a better customer experience from the outset means a higher chance of acquiring new customers and growing the business. Customer acquisition is historically an expensive and time-consuming endeavour, but technology can make the process faster, cheaper and smoother for all involved.

Increased customer retention and satisfaction – research shows that people stay with their financial institution for an average of 17 years; and even though the tide is shifting on customer loyalty in the sector, incorporating digital onboarding can still translate into enhanced customer satisfaction which flows through to a customer’s likelihood to stay on with the business. Invesp found that increasing customer retention by a mere 5% can have the potential to increase profits by 25-95%.

Tailored services – customers are increasingly demanding digital services and personalised interactions, particularly millennial and Gen Z customers who are becoming the primary demographic for goods and services. According to an Accenture study, 18% of US millennials switched their primary bank within a 12-month period, nearly double the average of other demographics. Introducing digital onboarding indicates to these customers that the business is willing to listen to them and provide services in a way that is tailored to their needs.

Minimise errors – through the utilisation of automation, digital onboarding removes human error and ensures that onboarding applications are submitted and assessed accurately, thus increasing the conversion rate and minimising drop-offs.

Streamlined compliance processes – regulation in the current climate is rife with ever-changing rules and requirements. Automating compliance and building it into onboarding processes using technology provides businesses with scale and flexibility to make changes when new regulations arise.

Increased employee satisfaction – eliminating monotonous and manual processes for employees will provide them with more satisfaction at work; they will have the opportunity to be involved in more value-add processes that give them increased job satisfaction and stimulation.

Learn more about incorporating compliance into your digital onboarding

If you’re considering introducing digital onboarding to your business processes, contact AsiaVerify. We are experts in facilitating real-time technological solutions to automate and incorporate compliance requirements in the Asia-Pacific region.

AsiaVerify offers a unique and market-leading service to meet UBO, KYB and KYC processes with unrivalled access to primary sources across Asia. We also facilitate easy comprehension and a convenient client experience through automatic translation and auto-filling from the local language to English.

Learn more about AsiaVerify’s services via our website or contact us to speak to a multilingual consultant about your digital onboarding needs.