AsiaVerify Resources Your Compliance Hub

Read more about AsiaVerify Introduces KYB Complete: Closing the Gap in Due Diligence

Read more about AsiaVerify Introduces KYB Complete: Closing the Gap in Due Diligence

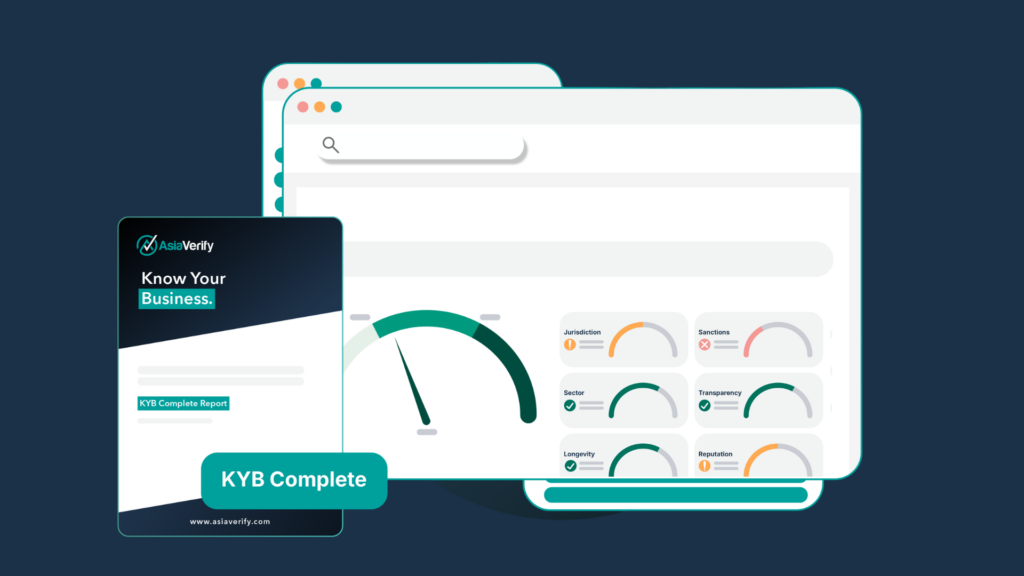

AsiaVerify Introduces KYB Complete: Closing the Gap in Due Diligence

AsiaVerify launches KYB Complete, delivering six-factor, decision-ready due diligence for China, Singapore, and Hong Kong supply chains.

Mind the Gap: Why Your Due Diligence Is Incomplete Without Asian Data

Without verified Asian registry data, your global due diligence is incomplete and you are left open to risk.

Read MoreForesight Completes Growth Investment to Scale AsiaVerify

Foresight Group has made a growth capital investment in AsiaVerify Limited, a RegTech intelligence platform providing real-time compliance and risk data on more than 447 million entities across 14 Asian jurisdictions.

Read MoreWhat the Venezuela Crisis Reveals about Asian Supply Chain Exposure

How Venezuela’s crisis is driving volatility across Asian supply chains, increasing risk exposure for global businesses and compliance teams.

Read MoreWhy Traditional Due Diligence Fails in Southeast Asia

Discover why outdated frameworks fail in Southeast Asia and how organisations can modernise with risk-focused, region-specific methods.

Read MoreInsights

Stay up to date with AsiaVerify Insights, industry developments, and regulatory updates shaping compliance in Asia.

View all resources in Insights Read more about Mind the Gap: Why Your Due Diligence Is Incomplete Without Asian Data

Read more about Mind the Gap: Why Your Due Diligence Is Incomplete Without Asian Data

Mind the Gap: Why Your Due Diligence Is Incomplete Without Asian Data

Guides

Step-by-step guides and expert insights to help you stay ahead of compliance challenges in APAC.

View all resources in GuidesVideos

Live and on-demand sessions with experts sharing practical approaches to compliance, onboarding, and fraud prevention.

View all resources in Videos Read more about Insights from Money20/20 Asia 2025: My Reflections on the Future of RegTech and Compliance

Read more about Insights from Money20/20 Asia 2025: My Reflections on the Future of RegTech and Compliance

Insights from Money20/20 Asia 2025: My Reflections on the Future of RegTech and Compliance

Read more about AsiaVerify Introduces KYB Complete: Closing the Gap in Due Diligence

Read more about AsiaVerify Introduces KYB Complete: Closing the Gap in Due Diligence

AsiaVerify Introduces KYB Complete: Closing the Gap in Due Diligence

AsiaVerify launches KYB Complete, delivering six-factor, decision-ready due diligence for China, Singapore, and Hong Kong supply chains.

Read more about Mind the Gap: Why Your Due Diligence Is Incomplete Without Asian Data

Read more about Mind the Gap: Why Your Due Diligence Is Incomplete Without Asian Data

Mind the Gap: Why Your Due Diligence Is Incomplete Without Asian Data

Without verified Asian registry data, your global due diligence is incomplete and you are left open to risk.

Read more about Foresight Completes Growth Investment to Scale AsiaVerify

Read more about Foresight Completes Growth Investment to Scale AsiaVerify

Foresight Completes Growth Investment to Scale AsiaVerify

Foresight Group has made a growth capital investment in AsiaVerify Limited, a RegTech intelligence platform providing real-time compliance and risk data on more than 447 million entities across 14 Asian jurisdictions.

Read more about What the Venezuela Crisis Reveals about Asian Supply Chain Exposure

Read more about What the Venezuela Crisis Reveals about Asian Supply Chain Exposure

What the Venezuela Crisis Reveals about Asian Supply Chain Exposure

How Venezuela’s crisis is driving volatility across Asian supply chains, increasing risk exposure for global businesses and compliance teams.

Read more about Why Traditional Due Diligence Fails in Southeast Asia

Read more about Why Traditional Due Diligence Fails in Southeast Asia

Why Traditional Due Diligence Fails in Southeast Asia

Discover why outdated frameworks fail in Southeast Asia and how organisations can modernise with risk-focused, region-specific methods.

Read more about Indonesia’s KYB Challenge: Balancing Growth and Risk

Read more about Indonesia’s KYB Challenge: Balancing Growth and Risk

Indonesia’s KYB Challenge: Balancing Growth and Risk

Indonesia’s rapid growth creates KYB risk. Learn why fragmented registries, UBO opacity and regulation make business verification in Indonesia complex.

Read more about AsiaVerify Accelerates Asia-Pacific RegTech Innovation with Expanded Platform for Smarter Onboarding and Monitoring at SFF 2025

Read more about AsiaVerify Accelerates Asia-Pacific RegTech Innovation with Expanded Platform for Smarter Onboarding and Monitoring at SFF 2025

AsiaVerify Accelerates Asia-Pacific RegTech Innovation with Expanded Platform for Smarter Onboarding and Monitoring at SFF 2025

AsiaVerify showcases new KYB, UBO, and monitoring tools at SFF 2025 to support faster, smarter onboarding.

Read more about Risk-Based KYB Monitoring: Meeting Regulatory Expectations in Asia

Read more about Risk-Based KYB Monitoring: Meeting Regulatory Expectations in Asia

Risk-Based KYB Monitoring: Meeting Regulatory Expectations in Asia

Learn how regulators across Asia expect firms to apply risk-based KYB monitoring, with real enforcement examples and best practices for ongoing compliance.

Read more about Verifying a Company in Indonesia: Complete KYB Guide

Read more about Verifying a Company in Indonesia: Complete KYB Guide

Verifying a Company in Indonesia: Complete KYB Guide

A practical guide to verifying Indonesian companies with AHU, OSS, and new GR 28/2025 requirements.

Read more about What is RegTech? Why It’s Redefining Compliance in Asia

Read more about What is RegTech? Why It’s Redefining Compliance in Asia

What is RegTech? Why It’s Redefining Compliance in Asia

Discover how RegTech is reshaping compliance in Asia, enabling faster onboarding and smarter risk management.

Read more about What CFOs Need to Know About UBO Verification in APAC

Read more about What CFOs Need to Know About UBO Verification in APAC

What CFOs Need to Know About UBO Verification in APAC

As Southeast Asia’s digital economy accelerates, so does the complexity of doing business across its borders.

Read more about The Hidden UBO Web: Why Risk-Aware Businesses Must Uncover Ownership Before It’s Too Late

Read more about The Hidden UBO Web: Why Risk-Aware Businesses Must Uncover Ownership Before It’s Too Late

The Hidden UBO Web: Why Risk-Aware Businesses Must Uncover Ownership Before It’s Too Late

Discover how hidden UBO links can derail deals and how to spot them with registry-backed data

Read more about From Risk to Resilience: Using KYB Data for Strategic Advantage

Read more about From Risk to Resilience: Using KYB Data for Strategic Advantage

From Risk to Resilience: Using KYB Data for Strategic Advantage

How mid-sized businesses are using KYB data to reduce risk and scale faster across Asia.

Read more about Citation & Data Usage Agreement

Read more about Citation & Data Usage Agreement

Citation & Data Usage Agreement

AsiaVerify’s Citation & Data Usage Agreement sets rules for attribution, disclaimers, and responsible data use.

Read more about Acceptable Use Policy (AUP)

Read more about Acceptable Use Policy (AUP)

Acceptable Use Policy (AUP)

AsiaVerify’s Acceptable Use Policy defines responsible use, prohibited activities, and enforcement to protect platform integrity.

Read more about Responsible AI in RegTech: Why Data Quality Matters

Read more about Responsible AI in RegTech: Why Data Quality Matters

Responsible AI in RegTech: Why Data Quality Matters

AI alone isn’t enough data quality is the real driver of effective RegTech outcomes

Read more about How to Verify a Thailand Company: A Step-by-Step Guide

Read more about How to Verify a Thailand Company: A Step-by-Step Guide

How to Verify a Thailand Company: A Step-by-Step Guide

Our step-by-step guide to verifying Thai companies using trusted local registry data.

Read more about Verifying Vietnamese Companies with Enhanced Official Data

Read more about Verifying Vietnamese Companies with Enhanced Official Data

Verifying Vietnamese Companies with Enhanced Official Data

Verify Vietnamese companies more confidently with enhanced access to official local registry data.

Read more about Insights from Money20/20 Asia 2025: My Reflections on the Future of RegTech and Compliance

Read more about Insights from Money20/20 Asia 2025: My Reflections on the Future of RegTech and Compliance

Insights from Money20/20 Asia 2025: My Reflections on the Future of RegTech and Compliance

Reflections on the future of RegTech, digital trust, and smarter compliance from Money20/20 Asia

Read more about Navigating the New Tariff Landscape: How Asian Supply Chains Are Evolving

Read more about Navigating the New Tariff Landscape: How Asian Supply Chains Are Evolving

Navigating the New Tariff Landscape: How Asian Supply Chains Are Evolving

Learn how changing tariffs are impacting supplier risk and reshaping trade across Asia

Read more about How to Verify a Company in Malaysia: A Practical Guide for Risk-Free Business Engagement

Read more about How to Verify a Company in Malaysia: A Practical Guide for Risk-Free Business Engagement

How to Verify a Company in Malaysia: A Practical Guide for Risk-Free Business Engagement

Follow this guide to run reliable KYB and UBO checks on Malaysian companies using official data

Read more about The Changing Trade Landscape: Why Merchant Verification Matters More Than Ever in Asia

Read more about The Changing Trade Landscape: Why Merchant Verification Matters More Than Ever in Asia

The Changing Trade Landscape: Why Merchant Verification Matters More Than Ever in Asia

Rising trade risk makes merchant verification a must for compliant onboarding in Asia

Read more about How to Verify a Chinese Company: A Step-by-Step Guide

Read more about How to Verify a Chinese Company: A Step-by-Step Guide

How to Verify a Chinese Company: A Step-by-Step Guide

Use this step-by-step guide to run business checks and identify UBOs in Chinese companies

Read more about Why UK Companies Must Strengthen Compliance in Asia

Read more about Why UK Companies Must Strengthen Compliance in Asia

Why UK Companies Must Strengthen Compliance in Asia

UK firms need stronger oversight to manage evolving compliance risks across Asia

Read more about RegTech Innovation in 2025: Key Principles for Smarter Compliance

Read more about RegTech Innovation in 2025: Key Principles for Smarter Compliance

RegTech Innovation in 2025: Key Principles for Smarter Compliance

Explore how smarter RegTech and automation are reshaping compliance heading into 2025

Read more about Understanding China’s Beneficial Ownership Filing: A Guide for Businesses

Read more about Understanding China’s Beneficial Ownership Filing: A Guide for Businesses

Understanding China’s Beneficial Ownership Filing: A Guide for Businesses

Learn how China’s new UBO filing rules affect risk, transparency, and due diligence processes

Read more about How Transparency Can Drive Business Success in Asia in 2025

Read more about How Transparency Can Drive Business Success in Asia in 2025

How Transparency Can Drive Business Success in Asia in 2025

Explore how transparency is becoming a key competitive driver for APAC business in 2025

Read more about Navigating Hong Kong’s New Credit Data Landscape with the MCRA Model

Read more about Navigating Hong Kong’s New Credit Data Landscape with the MCRA Model

Navigating Hong Kong’s New Credit Data Landscape with the MCRA Model

Learn how the MCRA model changes credit data access and KYB practices in Hong Kong

Read more about Visa: From AI to RTP top trends shaping 2025 payments

Read more about Visa: From AI to RTP top trends shaping 2025 payments

Visa: From AI to RTP top trends shaping 2025 payments

Visa highlights 2025 payment trends, including AI innovation and real-time payments shaping the industry

Read more about Recognised as a Leader: AsiaVerify Named a Top RegTech to Watch in 2025

Read more about Recognised as a Leader: AsiaVerify Named a Top RegTech to Watch in 2025

Recognised as a Leader: AsiaVerify Named a Top RegTech to Watch in 2025

AsiaVerify is recognised as a leading RegTech helping teams verify businesses across APAC with speed and accuracy

Read more about How to Access Reliable UBO Data in Asia

Read more about How to Access Reliable UBO Data in Asia

How to Access Reliable UBO Data in Asia

Discover where and how to access real-time UBO data across Asia’s diverse business landscape

Read more about Australia’s Beneficial Ownership Reforms: What You Need to Know

Read more about Australia’s Beneficial Ownership Reforms: What You Need to Know

Australia’s Beneficial Ownership Reforms: What You Need to Know

Understand how Australia’s UBO reforms affect your compliance and corporate transparency duties

Read more about Signicat Strengthens its APAC Presence Through Strategic Partnership with AsiaVerify

Read more about Signicat Strengthens its APAC Presence Through Strategic Partnership with AsiaVerify

Signicat Strengthens its APAC Presence Through Strategic Partnership with AsiaVerify

AsiaVerify partners with Signicat to bring trusted digital identity and onboarding solutions to APAC

Read more about Deloitte: Shaping the Future of Payments

Read more about Deloitte: Shaping the Future of Payments

Deloitte: Shaping the Future of Payments

Deloitte shares key insights on payment innovation, compliance, and trends shaping the industry’s future

Read more about The Transformative Power of AI in Financial Services

Read more about The Transformative Power of AI in Financial Services

The Transformative Power of AI in Financial Services

Explore how AI is streamlining onboarding, boosting insights, and transforming compliance workflows

Read more about AsiaVerify & M-DAQ Global Launch AI Compliance Tool CheckGPT™

Read more about AsiaVerify & M-DAQ Global Launch AI Compliance Tool CheckGPT™

AsiaVerify & M-DAQ Global Launch AI Compliance Tool CheckGPT™

AsiaVerify teams with M-DAQ to launch CheckGPT, an AI-driven tool for faster, smarter compliance checks in APAC

Read more about The Rise of RegTech and SupTech: Key Insights from the Singapore FinTech Festival

Read more about The Rise of RegTech and SupTech: Key Insights from the Singapore FinTech Festival

The Rise of RegTech and SupTech: Key Insights from the Singapore FinTech Festival

Gain key takeaways on RegTech and SupTech trends from the Singapore FinTech Festival

Read more about AsiaVerify wins Best KYB Solution at the Regulation Asia Awards 2024

Read more about AsiaVerify wins Best KYB Solution at the Regulation Asia Awards 2024

AsiaVerify wins Best KYB Solution at the Regulation Asia Awards 2024

AsiaVerify recognised as Best KYB Solution at the Regulation Asia Awards for compliance innovation

Read more about Payment Gateways: Turning Merchant Onboarding Challenges into Sales Wins

Read more about Payment Gateways: Turning Merchant Onboarding Challenges into Sales Wins

Payment Gateways: Turning Merchant Onboarding Challenges into Sales Wins

See how solving onboarding friction can help payment gateways unlock conversion and growth

Read more about Managing AML/CFT Risks in Asia: Tips for Trade Finance Lawyers

Read more about Managing AML/CFT Risks in Asia: Tips for Trade Finance Lawyers

Managing AML/CFT Risks in Asia: Tips for Trade Finance Lawyers

Get practical AML/CFT tips tailored for trade finance legal teams operating across Asia

Read more about Singapore strengthens AML framework. How does this impact your business?

Read more about Singapore strengthens AML framework. How does this impact your business?

Singapore strengthens AML framework. How does this impact your business?

Understand how Singapore’s updated AML framework changes onboarding and compliance obligations

Read more about How to Verify a Company in the Philippines: KYB and Compliance Guide

Read more about How to Verify a Company in the Philippines: KYB and Compliance Guide

How to Verify a Company in the Philippines: KYB and Compliance Guide

Step-by-step guide to verifying businesses in the Philippines with local registry data

Read more about AsiaVerify Wins Verification Technology Provider of the Year 2024

Read more about AsiaVerify Wins Verification Technology Provider of the Year 2024

AsiaVerify Wins Verification Technology Provider of the Year 2024

AsiaVerify recognised as Verification Technology Provider of the Year for innovation in compliance tech

Read more about KYB Challenges in Trade Finance: Strategies for Law Firms

Read more about KYB Challenges in Trade Finance: Strategies for Law Firms

KYB Challenges in Trade Finance: Strategies for Law Firms

Law firms face rising KYB risk in trade finance—this guide offers practical strategies to stay compliant

Read more about Merchant Onboarding: How to Increase Conversions With a Digital-First Approach

Read more about Merchant Onboarding: How to Increase Conversions With a Digital-First Approach

Merchant Onboarding: How to Increase Conversions With a Digital-First Approach

Speed up onboarding and win more merchants with a seamless, digital-first KYB experience

Read more about Proactive Compliance: The Benefits of Continuous Monitoring

Read more about Proactive Compliance: The Benefits of Continuous Monitoring

Proactive Compliance: The Benefits of Continuous Monitoring

Learn how real-time alerts and monitoring boost compliance confidence and reduce exposure

Read more about Unlocking Business Success: Leveraging Local Expertise to Identify Cross-Border Ultimate Beneficial Owners (UBOs)

Read more about Unlocking Business Success: Leveraging Local Expertise to Identify Cross-Border Ultimate Beneficial Owners (UBOs)

Unlocking Business Success: Leveraging Local Expertise to Identify Cross-Border Ultimate Beneficial Owners (UBOs)

This webinar is designed to provide professionals with crucial insights and methodologies for identifying ultimate beneficial owners (UBOs) across borders by leveraging local expertise.

Read more about How to Verify a Company in Indonesia: An insider’s guide

Read more about How to Verify a Company in Indonesia: An insider’s guide

How to Verify a Company in Indonesia: An insider’s guide

Step-by-step guide to verifying Indonesian companies using local sources and registry data

Read more about Terms & Conditions

Read more about Terms & Conditions

Terms & Conditions

Our Terms and Conditions govern your use of the services provided by AsiaVerify.

Read more about Cookie Policy

Read more about Cookie Policy

Cookie Policy

Our Cookie Policy outlines our usage of cookies for your browsing experience.

Read more about Privacy Policy

Read more about Privacy Policy

Privacy Policy

Our Privacy Policy outlines our commitment to protecting and securely handling your data.

Read more about Unlocking Asia’s Payment Potential: The Strategic Importance of Partnering with Local KYB Experts

Read more about Unlocking Asia’s Payment Potential: The Strategic Importance of Partnering with Local KYB Experts

Unlocking Asia’s Payment Potential: The Strategic Importance of Partnering with Local KYB Experts

Local KYB expertise helps payment providers scale securely and faster across Asian markets

Read more about How to Conduct a Thorough Singapore Business Check

Read more about How to Conduct a Thorough Singapore Business Check

How to Conduct a Thorough Singapore Business Check

Run reliable Singapore business checks with local data and registry-backed UBO screening

Read more about Managing AML Complexities to Unlock Cross-Border Growth in Asia

Read more about Managing AML Complexities to Unlock Cross-Border Growth in Asia

Managing AML Complexities to Unlock Cross-Border Growth in Asia

Unlock new markets by managing AML/CFT obligations across complex APAC jurisdictions

Read more about How Technology Powers Faster, Smarter Merchant Verification

Read more about How Technology Powers Faster, Smarter Merchant Verification

How Technology Powers Faster, Smarter Merchant Verification

See how automation and innovation streamline merchant onboarding and KYB at scale

Read more about Automated Merchant Onboarding: Key Advantages for PSPs

Read more about Automated Merchant Onboarding: Key Advantages for PSPs

Automated Merchant Onboarding: Key Advantages for PSPs

Discover how automated KYB tools improve speed, accuracy, and merchant onboarding success

Read more about Merchant Onboarding: How to Streamline Compliance and Growth

Read more about Merchant Onboarding: How to Streamline Compliance and Growth

Merchant Onboarding: How to Streamline Compliance and Growth

A digital-first approach to onboarding helps convert more merchants and reduce compliance delays

Read more about Global UBO Transparency: Why It Matters for Compliance

Read more about Global UBO Transparency: Why It Matters for Compliance

Global UBO Transparency: Why It Matters for Compliance

UBO transparency is evolving fast—learn how to stay compliant across APAC jurisdictions

Read more about How to Verify a Hong Kong Company | A Step-by-Step Guide

Read more about How to Verify a Hong Kong Company | A Step-by-Step Guide

How to Verify a Hong Kong Company | A Step-by-Step Guide

Use this guide to verify Hong Kong businesses and uncover UBOs using local registry data

Read more about Money20/20 Insights: Expanding in APAC with Compliance and Speed

Read more about Money20/20 Insights: Expanding in APAC with Compliance and Speed

Money20/20 Insights: Expanding in APAC with Compliance and Speed

Money20/20 insights: How compliance and onboarding are shaping APAC growth strategies

Read more about AsiaVerify Achieves ISO 27001 Certification

Read more about AsiaVerify Achieves ISO 27001 Certification

AsiaVerify Achieves ISO 27001 Certification

AsiaVerify achieves ISO 27001 certification, strengthening its commitment to data security and compliance

Read more about Merchant verification in the fast-lane

Read more about Merchant verification in the fast-lane

Merchant verification in the fast-lane

Speed up merchant KYB without cutting corners—learn how real-time tools reduce onboarding risk

Read more about How to Verify a Company in India: A Best Practice Approach

Read more about How to Verify a Company in India: A Best Practice Approach

How to Verify a Company in India: A Best Practice Approach

A practical guide to verifying Indian companies with registry data, UBO checks, and due diligence tips

Read more about How Automation and Expertise Are Transforming Merchant Onboarding

Read more about How Automation and Expertise Are Transforming Merchant Onboarding

How Automation and Expertise Are Transforming Merchant Onboarding

Blending automation with human expertise delivers faster, more accurate merchant onboarding outcomes

Read more about Celebrating Five Years of AsiaVerify: Reflections from Our Leaders

Read more about Celebrating Five Years of AsiaVerify: Reflections from Our Leaders

Celebrating Five Years of AsiaVerify: Reflections from Our Leaders

AsiaVerify celebrates five years, reflecting on growth, innovation, and leadership in APAC compliance

Read more about Birketts LLP Partners with AsiaVerify for China & Hong Kong KYB

Read more about Birketts LLP Partners with AsiaVerify for China & Hong Kong KYB

Birketts LLP Partners with AsiaVerify for China & Hong Kong KYB

Birketts LLP partners with AsiaVerify to deliver real-time business verification in China and Hong Kong

Read more about AsiaVerify Recognised by Chartis Research as a ‘One to Watch’

Read more about AsiaVerify Recognised by Chartis Research as a ‘One to Watch’

AsiaVerify Recognised by Chartis Research as a ‘One to Watch’

AsiaVerify recognised by Chartis Research as a RegTech to watch for compliance and verification innovation

Read more about The Future of KYB Compliance: Embracing Automation and Real-Time Insights

Read more about The Future of KYB Compliance: Embracing Automation and Real-Time Insights

The Future of KYB Compliance: Embracing Automation and Real-Time Insights

Real-time insights and automation are redefining how businesses approach KYB compliance

Read more about AsiaVerify Joins Visa Fintech Partner Connect Program

Read more about AsiaVerify Joins Visa Fintech Partner Connect Program

AsiaVerify Joins Visa Fintech Partner Connect Program

AsiaVerify joins Visa Fintech Partner Connect Program to boost APAC compliance and onboarding innovation

Read more about Why Tech-Driven Compliance Matters in APAC

Read more about Why Tech-Driven Compliance Matters in APAC

Why Tech-Driven Compliance Matters in APAC

Technology is unlocking faster, safer compliance as businesses scale across Asia

Read more about Trends That Will Shape KYB and Merchant Onboarding in Asia

Read more about Trends That Will Shape KYB and Merchant Onboarding in Asia

Trends That Will Shape KYB and Merchant Onboarding in Asia

Read more about How to Verify a Company in Australia: A Comprehensive Guide

Read more about How to Verify a Company in Australia: A Comprehensive Guide

How to Verify a Company in Australia: A Comprehensive Guide

Learn how to verify Australian companies using local registry data and UBO transparency best practices

Read more about Navigating APAC’s Unique KYB, UBO & KYC Challenges

Read more about Navigating APAC’s Unique KYB, UBO & KYC Challenges

Navigating APAC’s Unique KYB, UBO & KYC Challenges

Uncover the KYB, UBO, and KYC compliance complexities that global teams face in the APAC region

Read more about Corporate Transparency vs. Data Privacy: Finding the Balance in APAC

Read more about Corporate Transparency vs. Data Privacy: Finding the Balance in APAC

Corporate Transparency vs. Data Privacy: Finding the Balance in APAC

Can UBO transparency and data privacy co-exist? This guide explores how businesses are finding balance

Read more about Mastering KYC Data in Asia: Challenges and How to Address Them

Read more about Mastering KYC Data in Asia: Challenges and How to Address Them

Mastering KYC Data in Asia: Challenges and How to Address Them

Navigate Asia’s fragmented KYC data with tools and tactics for faster, cleaner onboarding

Read more about Identifying Ultimate Beneficial Owners in Asian Markets

Read more about Identifying Ultimate Beneficial Owners in Asian Markets

Identifying Ultimate Beneficial Owners in Asian Markets

Learn how to identify UBOs across APAC markets using verified registry data and ownership tracing tools

Read more about AsiaVerify Wins Most Innovative APAC Verification Technology

Read more about AsiaVerify Wins Most Innovative APAC Verification Technology

AsiaVerify Wins Most Innovative APAC Verification Technology

AsiaVerify wins Most Innovative APAC Verification Technology Award for its KYB and UBO compliance solutions

Read more about Webinar: OSINT Investigations on Chinese Companies

Read more about Webinar: OSINT Investigations on Chinese Companies

Webinar: OSINT Investigations on Chinese Companies

A guide to using OSINT for Chinese companies, helping uncover key compliance and business intelligence.

Read more about The Power of Open Source Data in Your KYC Investigations in Asia

Read more about The Power of Open Source Data in Your KYC Investigations in Asia

The Power of Open Source Data in Your KYC Investigations in Asia

Discover how open source data helps verify identities and flag risks in KYC checks across Asia

Read more about How to Verify a Japanese Company: A Step-by-Step Guide

Read more about How to Verify a Japanese Company: A Step-by-Step Guide

How to Verify a Japanese Company: A Step-by-Step Guide

Run fast, compliant business checks on Japanese entities using trusted registry data

Read more about The Power of Intelligent Language Translation for KYC in Asia

Read more about The Power of Intelligent Language Translation for KYC in Asia

The Power of Intelligent Language Translation for KYC in Asia

Smart translation tools remove language friction from KYB and due diligence across Asian markets

Read more about Unlocking the Power of Automation for Onboarding Asian Clients

Read more about Unlocking the Power of Automation for Onboarding Asian Clients

Unlocking the Power of Automation for Onboarding Asian Clients

Automation streamlines onboarding and helps teams navigate APAC’s complex compliance landscape

Read more about Communications

Read more about Communications

Communications

AsiaVerify protects your privacy and lets you choose the service, product, and event updates you receive.

Read more about New Feature Launch: Monitoring & AML Screening

Read more about New Feature Launch: Monitoring & AML Screening

New Feature Launch: Monitoring & AML Screening

AsiaVerify introduces two new features designed to enhance compliance speed and data accuracy across APAC

Read more about AsiaVerify Wins Prestigious Fintech Award at SFF 2022

Read more about AsiaVerify Wins Prestigious Fintech Award at SFF 2022

AsiaVerify Wins Prestigious Fintech Award at SFF 2022

AsiaVerify earns SFF Global FinTech Award from MAS, recognising its leadership in compliance innovation

Read more about AsiaVerify and Alibaba Announce Strategic Partnership

Read more about AsiaVerify and Alibaba Announce Strategic Partnership

AsiaVerify and Alibaba Announce Strategic Partnership

AsiaVerify teams up with Alibaba Cloud to deliver secure, scalable verification solutions across APAC

Read more about Compliance in a Brave New Regulated World

Read more about Compliance in a Brave New Regulated World

Compliance in a Brave New Regulated World

How compliance teams can stay ahead in a fast-changing, high-pressure regulatory environment

Read more about The Road Ahead in Fraud and Loss Prevention

Read more about The Road Ahead in Fraud and Loss Prevention

The Road Ahead in Fraud and Loss Prevention

Explore how smarter tools and local data can reduce fraud risk and losses across APAC markets

Read more about Digital Onboarding and Remote Identity Verification in APAC

Read more about Digital Onboarding and Remote Identity Verification in APAC

Digital Onboarding and Remote Identity Verification in APAC

Enable faster, safer onboarding with remote identity verification across APAC markets

Read more about Five Key Things to Know About UBOs (Ultimate Beneficial Owners)

Read more about Five Key Things to Know About UBOs (Ultimate Beneficial Owners)

Five Key Things to Know About UBOs (Ultimate Beneficial Owners)

Automation and local registry data are changing how UBO checks happen in real time

Read more about How Digital Onboarding Is Transforming Customer Verification

Read more about How Digital Onboarding Is Transforming Customer Verification

How Digital Onboarding Is Transforming Customer Verification

Digital transformation is accelerating change, reshaping industries, and unlocking new growth opportunities.

Read more about Why Identifying the UBO Matters: A Guide to Ownership Transparency

Read more about Why Identifying the UBO Matters: A Guide to Ownership Transparency

Why Identifying the UBO Matters: A Guide to Ownership Transparency

UBO investigations need precision—here’s what to ask and how to avoid common pitfalls

Read more about Why Identifying the Ultimate Beneficial Owner (UBO) Matters

Read more about Why Identifying the Ultimate Beneficial Owner (UBO) Matters

Why Identifying the Ultimate Beneficial Owner (UBO) Matters

Failing to find the UBO can expose your business to fraud, fines, or reputational damage

Read more about Global UBO Regulations: What Compliance Teams Need to Know

Read more about Global UBO Regulations: What Compliance Teams Need to Know

Global UBO Regulations: What Compliance Teams Need to Know

UBO rules are tightening worldwide—this guide maps out key regulations across jurisdictions

Read more about Understanding Multi-Layered Corporate Structures | UBO Explained

Read more about Understanding Multi-Layered Corporate Structures | UBO Explained

Understanding Multi-Layered Corporate Structures | UBO Explained

AsiaVerify is transforming business verification across the Asia Pacific region

Read more about How Technology Reveals the UBO: What You Need to Know

Read more about How Technology Reveals the UBO: What You Need to Know

How Technology Reveals the UBO: What You Need to Know

Murky ownership structures complicate UBO checks—here’s how to spot and resolve them

Read more about What Is a UBO? Understanding the Ultimate Beneficial Owner

Read more about What Is a UBO? Understanding the Ultimate Beneficial Owner

What Is a UBO? Understanding the Ultimate Beneficial Owner

Get clear on what a UBO is and why identifying ownership is vital to compliance and due diligence

Read more about Introducing AsiaVerify Co-Founder Jenny Li

Read more about Introducing AsiaVerify Co-Founder Jenny Li

Introducing AsiaVerify Co-Founder Jenny Li

AsiaVerify welcomes Jenny Li, bringing 15+ years’ expertise in finance, governance, and due diligence

Read more about Terms of Service

Read more about Terms of Service

Terms of Service

AsiaVerify’s Terms of Service outline account rules, content ownership, acceptable use, and dispute resolution.

Read more about Registered vs Paid-Up Capital in China

Read more about Registered vs Paid-Up Capital in China

Registered vs Paid-Up Capital in China

Capital figures can reveal red flags—know what to look for when engaging Chinese companies

Read more about Game-Changing Technology for Japan and Taiwan Company Check

Read more about Game-Changing Technology for Japan and Taiwan Company Check

Game-Changing Technology for Japan and Taiwan Company Check

AsiaVerify introduces OCR tech to streamline document processing and enhance APAC compliance accuracy

Read more about What You Need to Know About the Chinese Business License

Read more about What You Need to Know About the Chinese Business License

What You Need to Know About the Chinese Business License

A practical guide to decoding and verifying business licenses in China with confidence

Read more about Meet AsiaVerify’s new Chief Revenue Officer, Eelee Lua

Read more about Meet AsiaVerify’s new Chief Revenue Officer, Eelee Lua

Meet AsiaVerify’s new Chief Revenue Officer, Eelee Lua

Eelee Lua joins AsiaVerify as Chief Revenue Officer, bringing expertise to boost APAC growth

Read more about AsiaVerify Named ‘One to Watch’ in Regulation Asia Awards 2021

Read more about AsiaVerify Named ‘One to Watch’ in Regulation Asia Awards 2021

AsiaVerify Named ‘One to Watch’ in Regulation Asia Awards 2021

AsiaVerify named ‘One to Watch’ in Regulation Asia’s 2021 Awards, highlighting compliance innovation

Read more about AsiaVerify Named in the RegTech100 List 2022

Read more about AsiaVerify Named in the RegTech100 List 2022

AsiaVerify Named in the RegTech100 List 2022

AsiaVerify listed in the RegTech100, recognising leading innovators in regulatory technology

Read more about AsiaVerify Wins the Singapore SME 500 Award

Read more about AsiaVerify Wins the Singapore SME 500 Award

AsiaVerify Wins the Singapore SME 500 Award

AsiaVerify honoured with the Singapore SME 500 Award for excellence and business growth in APAC

Read more about AsiaVerify Completes an Oversubscribed Funding Round

Read more about AsiaVerify Completes an Oversubscribed Funding Round

AsiaVerify Completes an Oversubscribed Funding Round

AsiaVerify closes an oversubscribed funding round to drive growth and compliance innovation

Read more about CrowdFund Insider Interviews Founder Ficoal Dong

Read more about CrowdFund Insider Interviews Founder Ficoal Dong

CrowdFund Insider Interviews Founder Ficoal Dong

AsiaVerify delivers the tools to verify customers faster and stay compliant across the APAC region

Read more about How to Prepare for China’s New Privacy Law | PIPL Checklist

Read more about How to Prepare for China’s New Privacy Law | PIPL Checklist

How to Prepare for China’s New Privacy Law | PIPL Checklist

Learn how China’s new privacy law affects compliance, data use, and cross-border business

Read more about AsiaVerify Partners with Appway

Read more about AsiaVerify Partners with Appway

AsiaVerify Partners with Appway

AsiaVerify’s new UBO product enables fast, accurate ownership checks to meet APAC compliance needs

Read more about AsiaVerify & Merkle Science Partner to Enhance Crypto Compliance Across APAC

Read more about AsiaVerify & Merkle Science Partner to Enhance Crypto Compliance Across APAC

AsiaVerify & Merkle Science Partner to Enhance Crypto Compliance Across APAC

AsiaVerify’s new Power Duo strengthens crypto security with cutting-edge verification solutions.

Read more about AsiaVerify helps non-Chinese speakers to read documents

Read more about AsiaVerify helps non-Chinese speakers to read documents

AsiaVerify helps non-Chinese speakers to read documents

AsiaVerify enables seamless KYC/KYB by eliminating Chinese character translation challenges

Read more about AsiaVerify’s Eelee Lua Named Among SFA’s Women Leaders in FinTech

Read more about AsiaVerify’s Eelee Lua Named Among SFA’s Women Leaders in FinTech

AsiaVerify’s Eelee Lua Named Among SFA’s Women Leaders in FinTech

Eelee Lua recognised by SFA as a Women Leader in FinTech for her impact and leadership in the industry

Read more about Real-Time Japan & Taiwan Company Checks Powered by AsiaVerify

Read more about Real-Time Japan & Taiwan Company Checks Powered by AsiaVerify

Real-Time Japan & Taiwan Company Checks Powered by AsiaVerify

Step-by-step guidance to verify companies in Japan and Taiwan for compliance and trusted business deals